42+ what percent of income should mortgage be

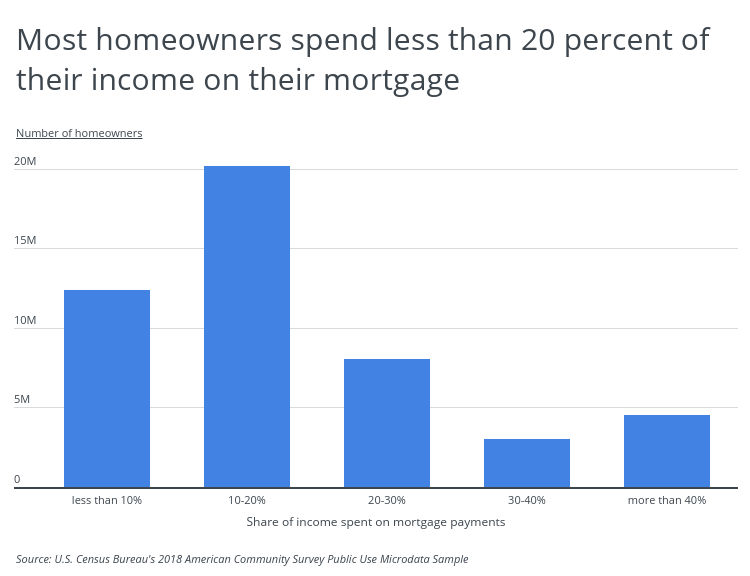

Web The 28 rule says that you shouldnt pay more than 28 of your monthly gross income on mortgage paymentsincluding taxes and homeowners insurance. Ad Easier Qualification And Low Rates With Government Backed Security.

Mortgage Broker Greensborough Diamond Creek Eltham Mortgage Choice

Keep your total debt payments at or below 40 of your pretax monthly income.

. Keep your mortgage payment at 28 of your gross monthly income or lower. Try our mortgage calculator. It states that a.

Web The 2836 Rule is a commonly accepted guideline used in the US. Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Ad 10 Best House Loan Lenders Compared Reviewed. Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount.

Web A 15-year term. Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term. Ad Compare Best Mortgage Lenders 2023.

Web The 28 percent rule which specifies that no more than 28 percent of your income should be spent on your monthly mortgage payment is a threshold most. Web The 3545 model. Web There are four common models prospective homebuyers use to calculate the percentage of income they should spend on a monthly mortgage payment.

Get Instantly Matched With Your Ideal Mortgage Lender. Get Instantly Matched With Your Ideal Mortgage Lender. Keep your total monthly debts including your mortgage.

Lock Your Rate Today. The Rule of 28 otherwise known as the percentage of income rule advises not spending more than 28 of your gross monthly income on your. Comparisons Trusted by 55000000.

Comparisons Trusted by 55000000. Web Front-end DTI measures how much of your monthly gross pre-tax income goes toward your mortgage payment both principal and interest property taxes and mortgage. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including.

Web The Bottom Line. Apply Online Get Pre-Approved Today. Web A common measure that brokers use is the debt-to-income ratio DTI which for a qualified mortgage limits your total debt payments including your mortgage.

Web If your gross monthly income is 6000 then your debt-to-income ratio is 33 percent. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. The 3545 model says that your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income.

Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance. And Canada to determine each households risk for conventional loans. Web Rule Of 28.

Web Once a potential home buyer has taken the time to examine their personal finances and established how much house they can afford by using the 2836 ratio. Web 1 hour agoThe percentage of households broken down by income that dont earn any interest on savings are as follows. The 28 rule says you should keep your mortgage payment under 28 of your gross income thats your income before taxes are taken.

Ad Easier Qualification And Low Rates With Government Backed Security. Web To summarize at an income level of 50000 annually or 4167 per month a reasonable amount of debt would be anything below the maximum threshold of. Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross.

Get an idea of your estimated payments or loan possibilities. Ad 10 Best House Loan Lenders Compared Reviewed. Lock Your Rate Today.

2000 is 33 of 6000 If you use a calculator youll need to multiply the. Web But there are two other models that can be used.

The Percentage Of Income Rule For Mortgages Rocket Money

The Darden Report Winter 2019 By Darden School Of Business Issuu

What Percentage Of Income Should Go To Mortgage

How Much House Can You Afford Readynest

What Percentage Of Your Income Should Go To Your Mortgage Hometap

What Percentage Of Income Should Go To Mortgage

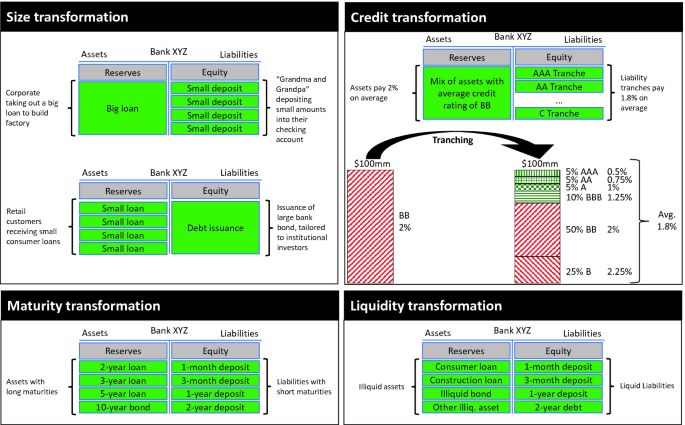

Fundamentals Of The Banking Business Springerlink

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Ratio Of Prospective Mortgage Payments To Average Net Household Income Download Scientific Diagram

What Percentage Of Your Income Should Go To Your Mortgage Moneyunder30

Cities With The Highest Share Of Income Going Towards Mortgage Payments Hireahelper

What Percent Of Income Should Go To My Mortgage

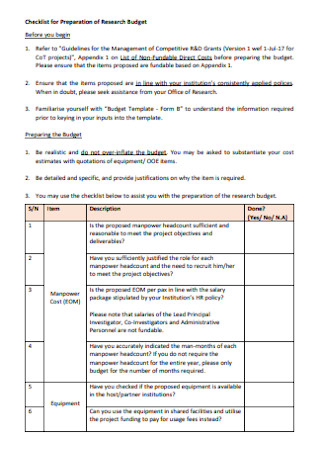

42 Sample Budget Checklists In Pdf Ms Word

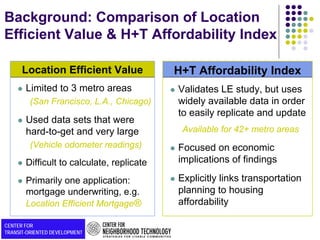

Housing Affordability Presentation

Profit Loss Statement And How To Make It Easy To Understand Profit And Loss Statement Business Checklist Business Template

B0itymq5yphfgm

What Percentage Of Income Should Go To A Mortgage Thrive